Simple interest is the annual share of a loan amount that must be paid to the lender in addition to the principal quantity of the loan. The complete greenback amount of curiosity is determined by the size of time it takes for the mortgage to be repaid. Compound interest on loans, significantly with frequent compounding, can escalate debt rapidly. Recognising its influence can help you prioritise high-interest debt repayment, lowering monetary strain and releasing up investment resources.

How Does The Compounding Frequency Impression Growth?

Because it doesn’t account for compounding, you won’t earn interest on the money you’ve amassed in interest. If you’re borrowing money with compound interest, this means you’ll pay interest on the principal plus any interest that has constructed up. If you are depositing money within the financial institution, it means the curiosity cost in your money will develop over time in actual dollar phrases. Compound curiosity accelerates over time as every compounding period provides curiosity to the rising principal, producing quicker progress. Easy Interest is the best approach to calculate curiosity on a principal quantity. For example, in case your savings account earns 6% annually, divide 72 by 6 to get 12 years on your cash to double.

The extra typically your curiosity compounds, the more interest you’ll earn on your investment. Keep In Mind, slightly knowledge about rates of interest can go a good distance in ensuring your money works for you, not towards you. Take the time to use these calculations to your individual monetary situation and start building a safer future at present. If you borrow $1,000 and pay a easy rate of interest of 7% for five years, then you definitely would pay a complete of $350 in simple interest on the debt. If you invest $10,000 in a bond that pays a 5% coupon, then you would annually receive $500 until the bond reaches maturity. Compound curiosity on savings can benefit you tremendously, particularly should you’re younger with a few years to save lots of ahead of you.

Curiosity could be compounded annually, semi-annually, quarterly, monthly, daily, or even continuously. The more frequent the compounding, the higher the ultimate amount, although the distinction between every day and steady compounding is minimal for sensible purposes. Finally, compound interest is a robust device that can assist you to attain your financial targets. Be positive to reap the benefits of this software by utilizing accounts that supply compound curiosity in your investments. And should you’re ever tempted to hold a balance on your bank card, remember that the power of compounding interest can work in opposition to you, too.

Some loans also use simple curiosity, together with personal loans, pupil loans and auto loans. These loans are typically paid again over a shorter time frame than savings accounts, so the bank does not have to charge as high of an rate of interest to make money. Understanding rates of interest is crucial for anybody coping with loans or savings.

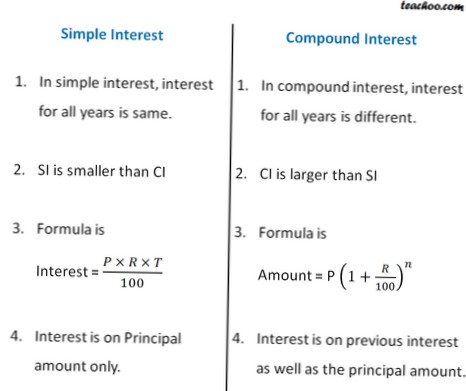

Simple Interest Vs Compound Curiosity: What’s The Difference?

Interest payments are usually calculated as a proportion of the principal that the borrower borrowed from the lender. Some personal loans and simpler shopper products use simple curiosity. Most financial institution deposit accounts, mortgages, bank cards, and some traces of credit tend to use compound interest. Compounding can work against you, however, if you carry loans with very excessive charges of interest like bank card or department retailer debt. A credit card stability of $25,000 carrying at an rate of interest of 20% compounded month-to-month would lead to a complete curiosity charge of $5,485 over one 12 months or $457 per month.

The existence of a fiduciary responsibility does not forestall the rise of potential conflicts of curiosity. For example, if you resolve to speculate $2,000 in a money market account with a simple rate of interest of 8.5%, you’ll earn $170 in interest after one 12 months ($2,000 x 0.085). The method for compound interest is slightly more advanced, nevertheless it’s important for understanding long-term financial progress. Simple interest is simple to know and calculate, nevertheless it doesn’t account for the growth potential of your money over time.

- Some frequent kinds of accounts that pay compound interest embody financial savings accounts, cash market accounts, and certificates of deposit (CDs).

- With simple interest, you earn $100 each year (10% of $1,000), totaling $1,000 in curiosity for a ultimate amount of $2,000.

- Credit card firms often utilize compound interest to cost customers extra money.

Mainly, easy curiosity is curiosity paid on the unique principal solely while compound interest is curiosity paid not solely on the principal, but also on the curiosity https://www.simple-accounting.org/ previously earned. The formulation that show the difference between easy curiosity and compound interest are proven below. Many folks underestimate compound interest’s power in early years and overestimate it in later years. The development appears sluggish initially as a result of the base is small, leading some to think compound interest is not working. Conversely, some count on unrealistic returns, not understanding that sustainable compound growth requires endurance and affordable return expectations.

Compounding frequency refers to how typically interest is calculated and added to the principal within a given period. This frequency considerably impacts how fast investments grow or money owed accumulate. If you have a credit card and you owe money on it, you will pay less interest if the credit card company makes use of simple curiosity. Most credit cards will use compound curiosity and the frequency of compounding could be every day in order that they will earn as a lot curiosity as possible. In The Meantime, compound curiosity typically is healthier than simple curiosity for savers and buyers.

It earned compound interest at an annual rate of interest of zero.72\% for 5 years. Simple and compound curiosity are basic ideas that affect borrowing prices and funding returns. Simple curiosity can be utilized by debtors who prefer predictable and manageable repayment plans. Compound curiosity, with its exponential growth potential, is right for long-term investment methods aimed at building wealth. Compound Interest is the interest calculated on the preliminary principal and also on the accrued curiosity from earlier durations.